Uk Fca Aml Handbook

The idea of money laundering is essential to be understood for those working in the financial sector. It's a process by which soiled cash is transformed into clear money. The sources of the cash in actual are criminal and the money is invested in a manner that makes it appear like clean cash and conceal the identification of the criminal a part of the cash earned.

While executing the financial transactions and establishing relationship with the new prospects or maintaining present customers the responsibility of adopting ample measures lie on each one who is part of the organization. The identification of such element to start with is easy to deal with instead realizing and encountering such situations in a while in the transaction stage. The central bank in any country provides full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present enough safety to the banks to deter such conditions.

The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. Posted on August 30 2018 November 25 2018 by Informer.

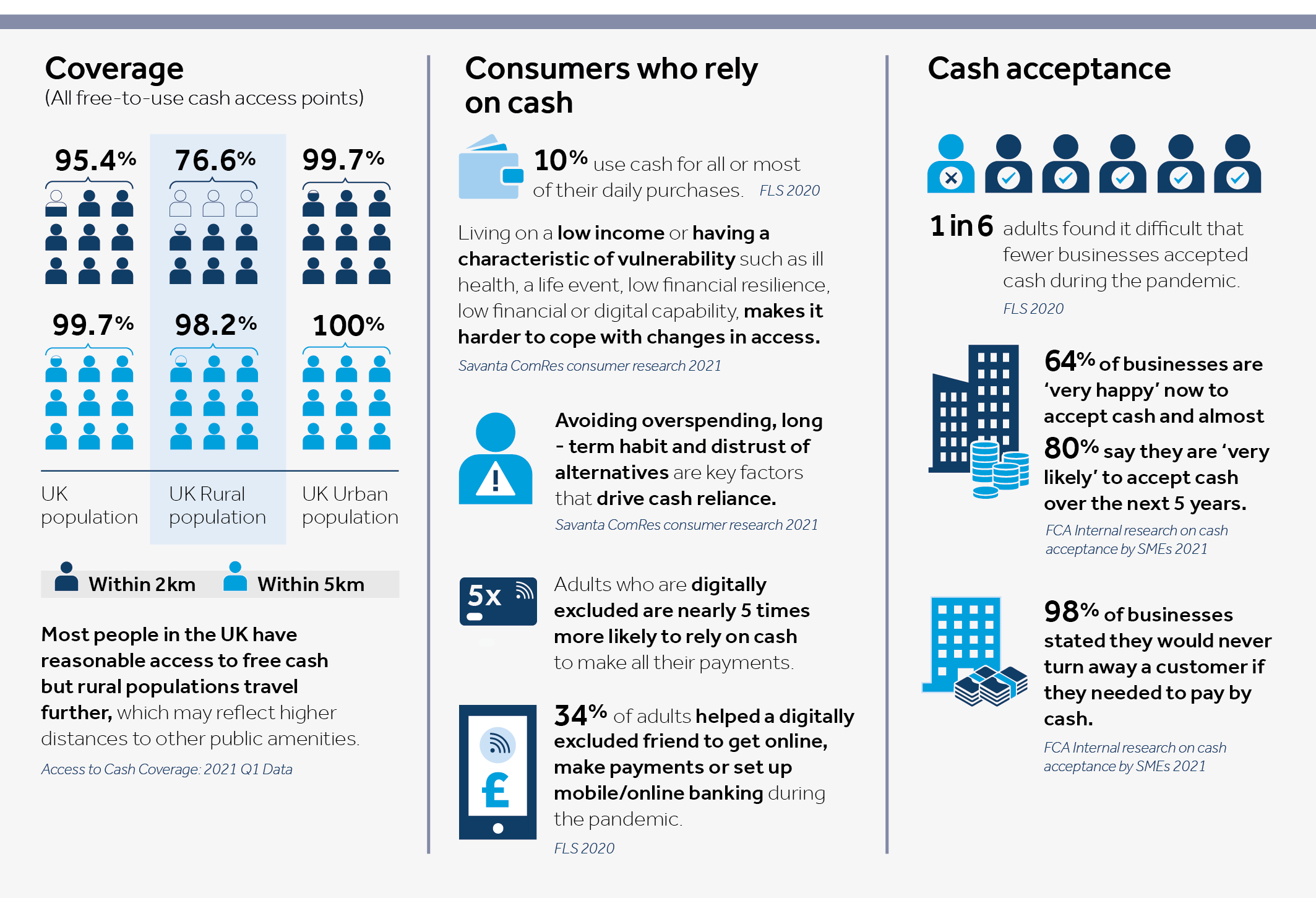

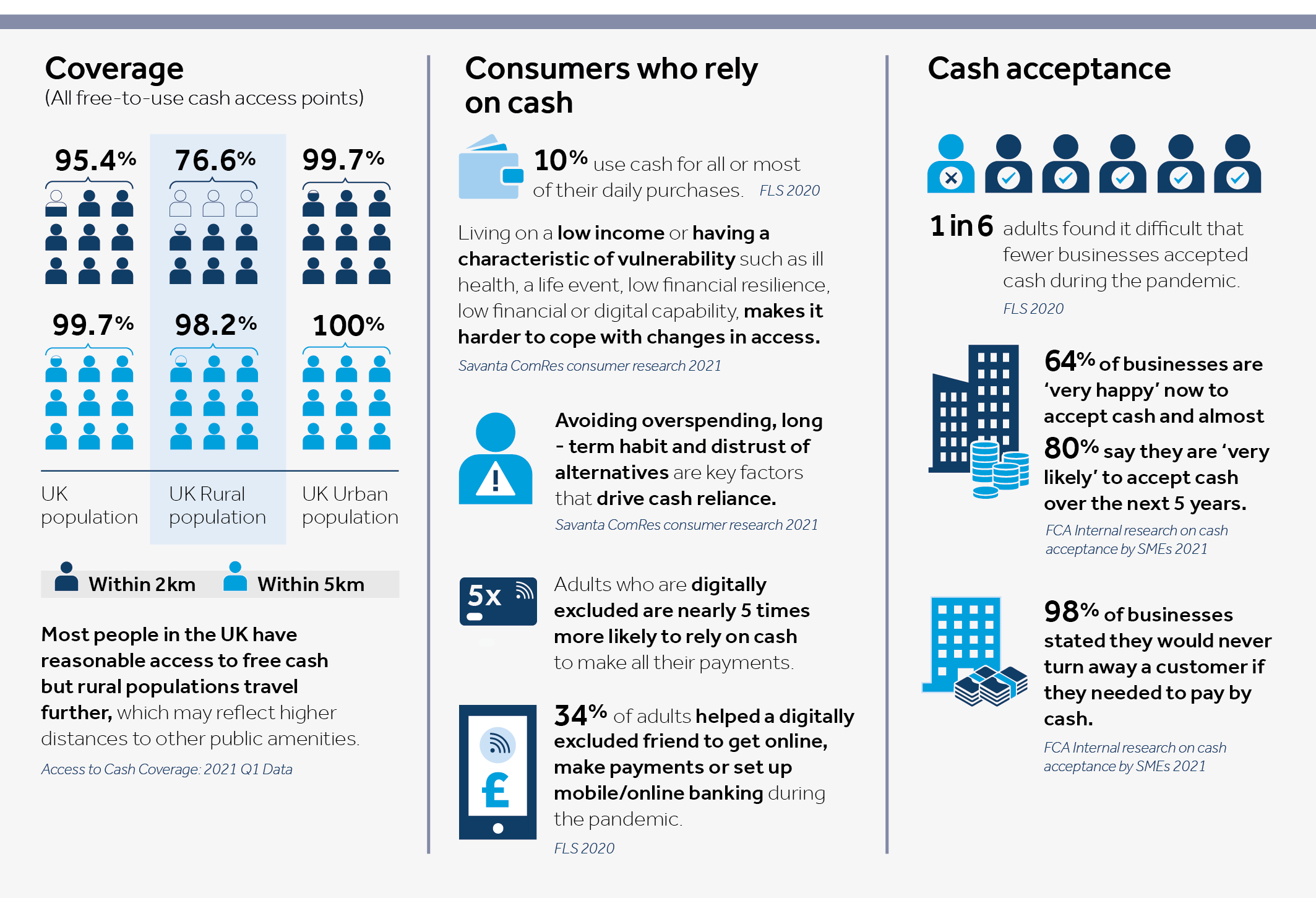

Uk S Cash Infrastructure And Consumer Research Fca

Compliant Business Management Independent Financial Adviser Information Update Products Services Advisers Miss the new PROD Rules Quoted Post.

Uk fca aml handbook. FCTR 412 G 13122018. Dependant on the size of the organisation the appointed person may require a team to assist in the assessment and management aspects and will. HIRETT LTD and its staff are committed to the highest standards of anti-money laundering AML including anti-fraud anti-corruption and taking measures to mitigate against financial crime.

The FCA oversees compliance with AML regulations in the UK and has the power to investigate money laundering and terrorism financing offenses in conjunction with other law enforcement agencies and authorities such as the Crown Prosecution Service CPS. Dual-regulated firms will need to consider both FCA and Prudential Regulation Authority PRA rules so should also refer to the PRA Rulebook. The Companys nominated officerMLROAML lead has been appointed to carry out the money laundering risk assessment and to record the necessary information and report the results to the Senior Management TeamDirectors.

GEN Sch 3 Fees and other required payments. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. 22 Risk Assessment Team.

The FCA require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. 4478 3368 4449 Email. There may be firms particularly smaller firms that monitor credibly and effectively using manual procedures.

Suitable for those looking to comly with the FCA Handbook rules or to gain FCA authorisation. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. The Financial Conduct Authority is the conduct regulator for 58000 financial services firms and financial markets in the UK and the prudential regulator for over 24000 of those firms.

All banks and financial institutions in the UK must register with the FCA. The FCAs action serves as a valuable reminder to firms not only of their obligations under Principle 11 of the FCAs Principles for Businesses but also for firms to take particular care when notifying the FCA of incidents or issues that are connected even at a general level to matters that the FCA. GEN TP 5 Transitional provisions applying across the FCA Handbook and Technical Standards relating to the UKs exit from the EU.

You can click Join Up to create an account for adding favourites and setting update alerts. Financial Conduct Authority FCA. All regulated firms must comply with the rules set out in the Handbook.

1 enable it to identify assess monitor and manage money laundering risk. GEN Sch 2 Notification requirements. FCA Handbook Welcome to the website of the Financial Conduct Authoritys Handbook of rules and guidance.

In the United Kingdom one of the most prominent tools in the Anti-Money Laundering AML space is the Financial Conduct Authority FCA handbook1. A firm must ensure the policies and procedures established under SYSC 611 R include systems and controls that. The handbook guides Firms across a range of topics from Financial Reporting Requirements2 to Market Abuse Regulation MAR and Market Conduct3.

The FCA Handbook contains the complete record of FCA Legal Instruments and presents changes made in a single consolidated view. The Handbook contains the complete record of FCA Legal Instruments and presents changes made in a single consolidated view. OPBAS is the Office for Professional Body Anti-Money Laundering Supervision The Office for Professional Body Anti-Money Laundering Supervision OPBAS is a new regulator set up by the government to strengthen the UKs anti-money laundering AML supervisory regime and ensure the professional body AML supervisors provide consistently high standards of AML supervision.

These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. Know Your Compliance Limited specialise in developing FCA Policy Templates and regulatory compliance policies procedures checklists and training packages. 2 are comprehensive and proportionate to the nature scale and complexity of.

We also provide policy templates and procedures for the UK GDPR AML. GEN TP 6 Transitional provisions applying to GEN only - status disclosure for temporary permission firms. GEN Sch 1 Record keeping requirements.

Crypto License Uk Fca Crypto Registration Best Explained Psp Lab

Demystifying The Fca S Demands A Detailed Guide For The Uk S Aml Requirements Sumsub Com

What Does The Fca Mean Ready Willing Organised Fca Authorisation Speci Fca Organization Financial Services

Fca Template Compliance Guidelines Manual

What Is The Financial Conduct Authority Fca Uk Psp Lab

Crypto License Uk Fca Crypto Registration Best Explained Psp Lab

Ps21 4 Extension Of Annual Financial Crime Reporting Obligation Fca

Fca Compliance Monitoring Plan Template For Fca Authorisations In 2021 How To Plan Compliance How To Apply

Https Www Handbook Fca Org Uk Form Sup Sup 10c Ann 3d Solo Long Form A 20191209 Pdf

Life Beyond Brexit Key Aspects From The Fca S Business Plan Planet Compliance

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An

Drop Down List Compliance Consultant Services Uk Financial Services Financial Services Regulatory Compliance Compliance

Https Www Handbook Fca Org Uk Form Sup Sup 10a Ann 04 Form A Mifid Notes 20170130 Pdf Date 2017 03 07

The world of regulations can appear to be a bowl of alphabet soup at times. US money laundering regulations are no exception. We have now compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Threat is consulting agency targeted on protecting monetary providers by reducing risk, fraud and losses. We've huge bank experience in operational and regulatory threat. We've got a powerful background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many hostile penalties to the organization due to the dangers it presents. It will increase the likelihood of major dangers and the chance value of the bank and in the end causes the bank to face losses.

Komentar

Posting Komentar